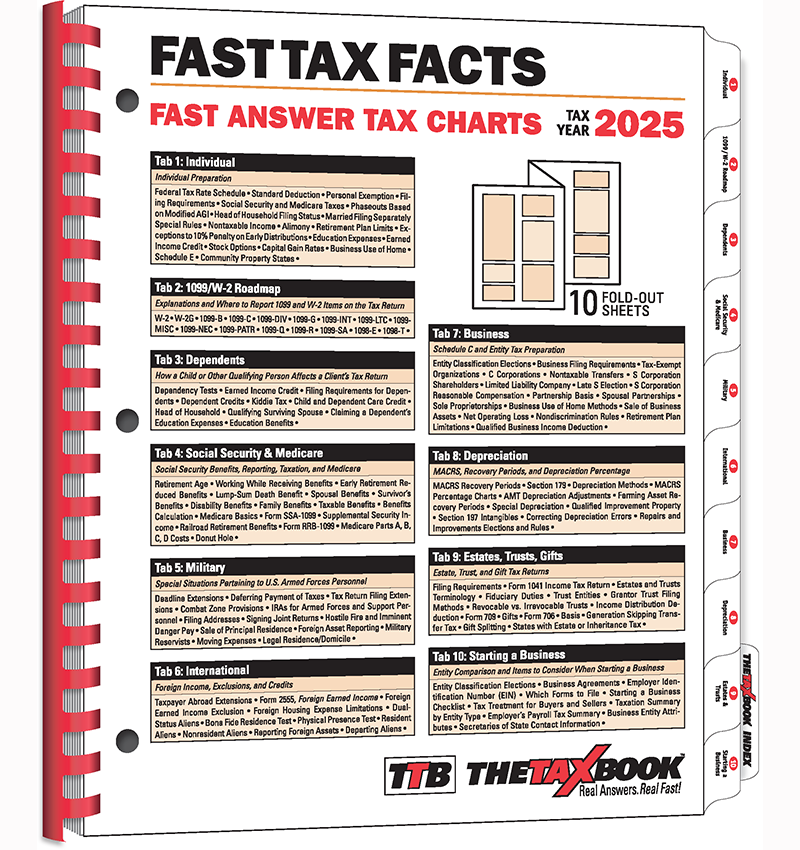

Tab 1

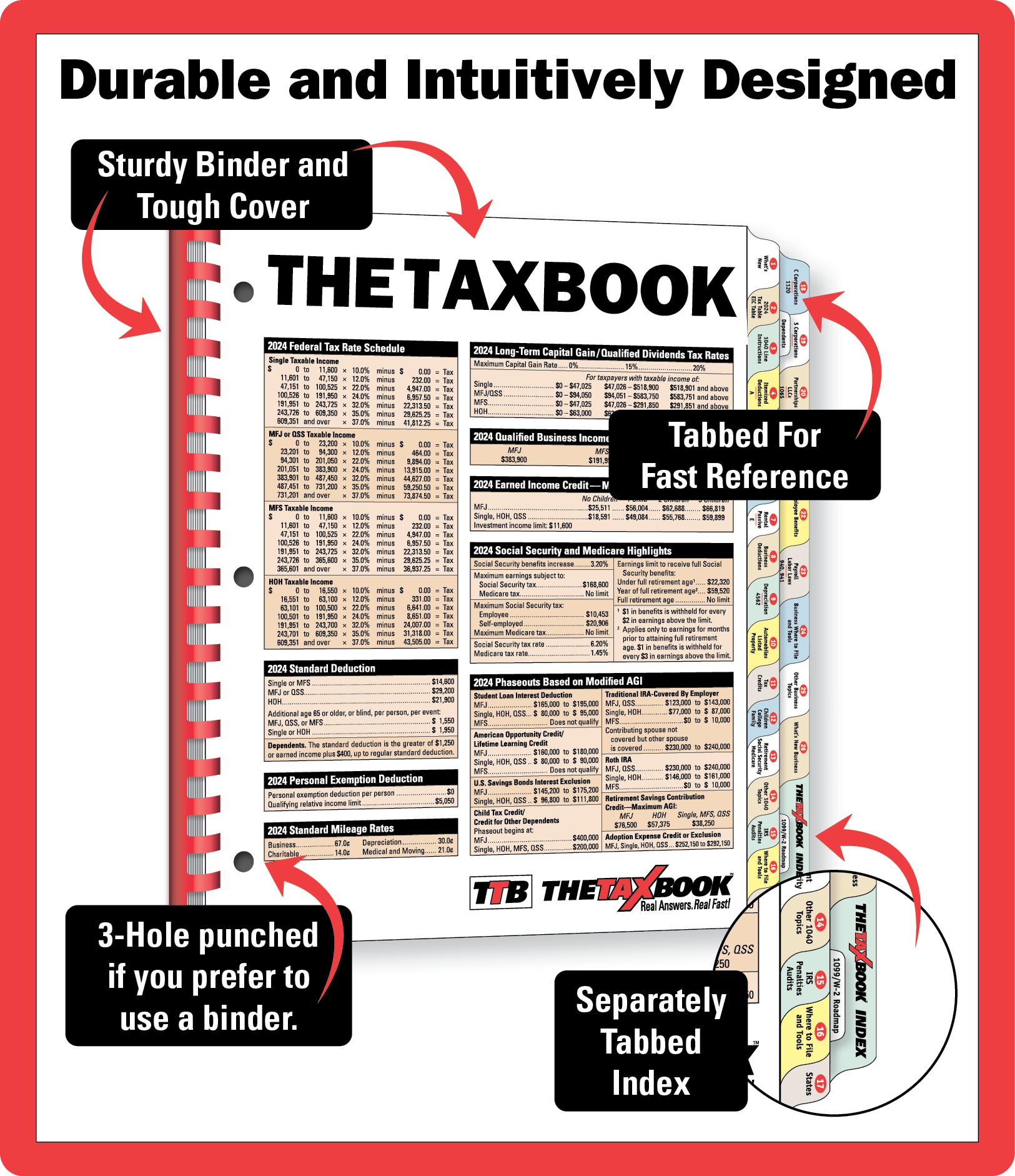

Federal Tax Rate Schedule

Standard Deduction

Personal Exemption Deduction

Penalty for Not Having Health Insurance

Kiddie Tax

Filing Requirement

Social Security and Medicare Taxes

Phaseouts Based on Modified AGI

Head of Household Filing Status Chart

Refund Status

Identity Protection PIN (IP PIN)

Married Filing Separately - Special Rules

Nontaxable Income - Excluded

Alimony Requirements

Retirement plan Limits

IRA Limits

Exceptions to 10% Penalty on Early Distributions

Retirement Savings Contribution Credit Chart

AMT Exemption Amount and Phaseout Range

Community Property States

Health Savings Account (HSA) Limits

Cafeteria Plan - Health FSA Limit

QSEHRA Limits

Earned Income Credit Chart

Schedule A (Form 1040) Highlights

Student Loan Interest Deduction

Preparer Due Diligence

Dependent Credits

American Opportunity Credit

Lifetime Learning Credit

Education Expenses

Tax Rats: Capital Gain and Dividend Income

Estate and Gift Tax

Tax Treatment of Stock Options

Household Employee Filing Requirements Chart

Net Investment Income Tax

Standard Mileage Rates

Per Diem Rates - Continental U.S. (CONUS)

Business Use of Home Methods

Deduction Shareholder's Suspended Pass-Through Losses

Partnerships

Schedule E (Form 1040) Details

Rental Activity Income

Rental Real Estate Loss for Individuals

How to Classify Rental Property for Tax Treatment

Tab 2

W-2, Wage Statement

W-2G, Certain Gambling Winnings

1099-MISC, Miscellaneous Income

1099-INT, Interest Income

1099-DIV, Dividends and Distributions

1099-B, Proceeds From Broker and Barter Exchange Transactions

1099-S, Proceeds From Real Estate Transactions

1099-R, Distributions From Pensions, Annuities, Retirement, or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

1099-G, Certain Government Payments

1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

Form 1098-E, Student Loan Interest Statement

Form 1098-T, Tuition Statement

1099-Q, Payments From Qualified Education Programs (Under Section 529 and 530)

Form 1099-A, Acquisition or Abandonment of Secured Property

Form 1099-C, Cancellation of Debt

1099-LTC, Long-Term Care and Accelerated Death Benefits

1099-PATR, Taxable Distributions Received From Cooperatives

Tab 3

Dependency Tests Chart

Qualifying Child for Earned Income Credit (EIC) Chart

Earned Income Credit Additional Information Chart

Filing Requirements for Dependents Chart

Dependent Credits Chart

Kiddie Tax Chart

Qualifying Person for Child and Dependent Care Credit Chart

Child and Dependent Care Expenses Chart

Child and Dependent Care Credit Flow Chart

Claiming a Dependent's Education Expenses Chart

Qualifying Person for Head of Household Chart

Qualifying Widow(er) With Dependent Child Chart

Education Benefits Chart

Tab 4

Social Security & Medicare

More

Social Security - How to Qualify for Benefits

Taxability of Social Security Benefits

Working While Receiving Social Security Benefits

Social Security - Full Retirement Age

Lump-Sum Death Benefits

Social Security and Medicare Highlights

Social Security - Early Retirement Reduced Benefits

Social Security Benefits - Types and Requirement to Receive

Social Security - Taxable Benefits

Medicare - Basics

Medicare Eligibility

Medicare Part A, B, C, D

Medicare Basic Coverage

Supplement Security Income (SSI)

Railroad Retirement Benefits

Form SSA-1099

Form RRB-1099

Medicare Costs

Contact Information

Tab 5

Extensions for Military Personnel

Interest-Free Deferral Request

Combat Zone Tax Provisions

IRAs for Military Personnel

Income Exclusions/Inclusions

Joint Returns for Military Couples

Combat Zone Provisions for Deceased Taxpayer

Military Service and Principal Residence

Foreign Asset Reporting

Military Reservists

VA Benefits and Retiree Pay

CRDP and CRSC Payment to Military Retirees

Moving Expenses of Military Taxpayers

Legal Residence/Domicile

Home of Record

Tab 6

Taxation of Worldwide Income

Resident Aliens

Taxpayer Abroad Extension Summary

Form 2555, Foreign Earned Income

Bona Fide Residence Test

Physical Presence Test

Tax Home in a Foreign Country

Foreign Housing Expenses

Form 1116, Foreign Tax Credit

Individual Taxpayer Identification Number (ITIN)

Tax Treaties and Totalization Agreements

Reporting Foreign Assets

Dual-Status Aliens

Expatriation Tax

Exempt Aliens

Tab 7

C Corporations

Net Operating Loss (NOL)

Business Filing Requirements

Limited Liability Company (LLC)

Qualified Business Income (QBI) Deduction

Reduced QBI Deduction

Specified Service Trade or Business (SSTB)

Personal Service Corporations

Nondiscrimination Rules Chart

Where to Deduct Qualified Pension Plan and IRA Contributions Chart

Entertainment Expense Deduction

Like-Kind Exchanges

Where to Deduct Interest Expense

Section 179 Limits

Partnership Basis

Spousal Partnerships

Tax-Exempt Organizations

S Corporation Reasonable Compensation

S Corporation Shareholder's Basis Adjustments

Relief for Late S Corporation Elections

Tab 8

MACRS Recovery Periods

MACRS Percentage Charts

Section 179 Limits

MACRS Depreciation Methods

Depreciation and Alternative Minimum Tax

Qualified Real Property

Depreciation Formulas

Vehicle Depreciation Limitations

Farming Asset Recovery Periods

Repairs vs. Improvements

Special Depreciation Allowance

Amortization

Section 197 Intangibles

MACRS Conventions

Correcting Depreciation Errors

Tab 9

Estates, Trusts, Gifts

More

MACRS Recovery Periods

Repairs

Improvements

Betterments

Restorations

Adaptations

Small Taxpayer Safe Harbor Election

Unit of Property

Partial Dispositions

Materials and Supplies

Remodel-Refresh Safe Harbor

Units of Property

Routine Maintenance Safe Harbor

Capitalize Repair and Maintenance Costs Election

De Minimis Safe Harbor Election

Tab 10

Entity Classification Elections

Business Agreements

Employer Identification Numbers (EIN)

Which Forms to File

Starting a Business Checklist

Tax Treatment for Buyers and Sellers

Interview Questions

Business Planning

Tax Treatment for Buyers and Sellers

Special Rules for Various Types of Employment

Taxation Summary - Corporations and Partnerships

Employer's Payroll Tax Calendar

S Corporation Election

Business Entity Pros and Cons

Secretaries of State Contact Information