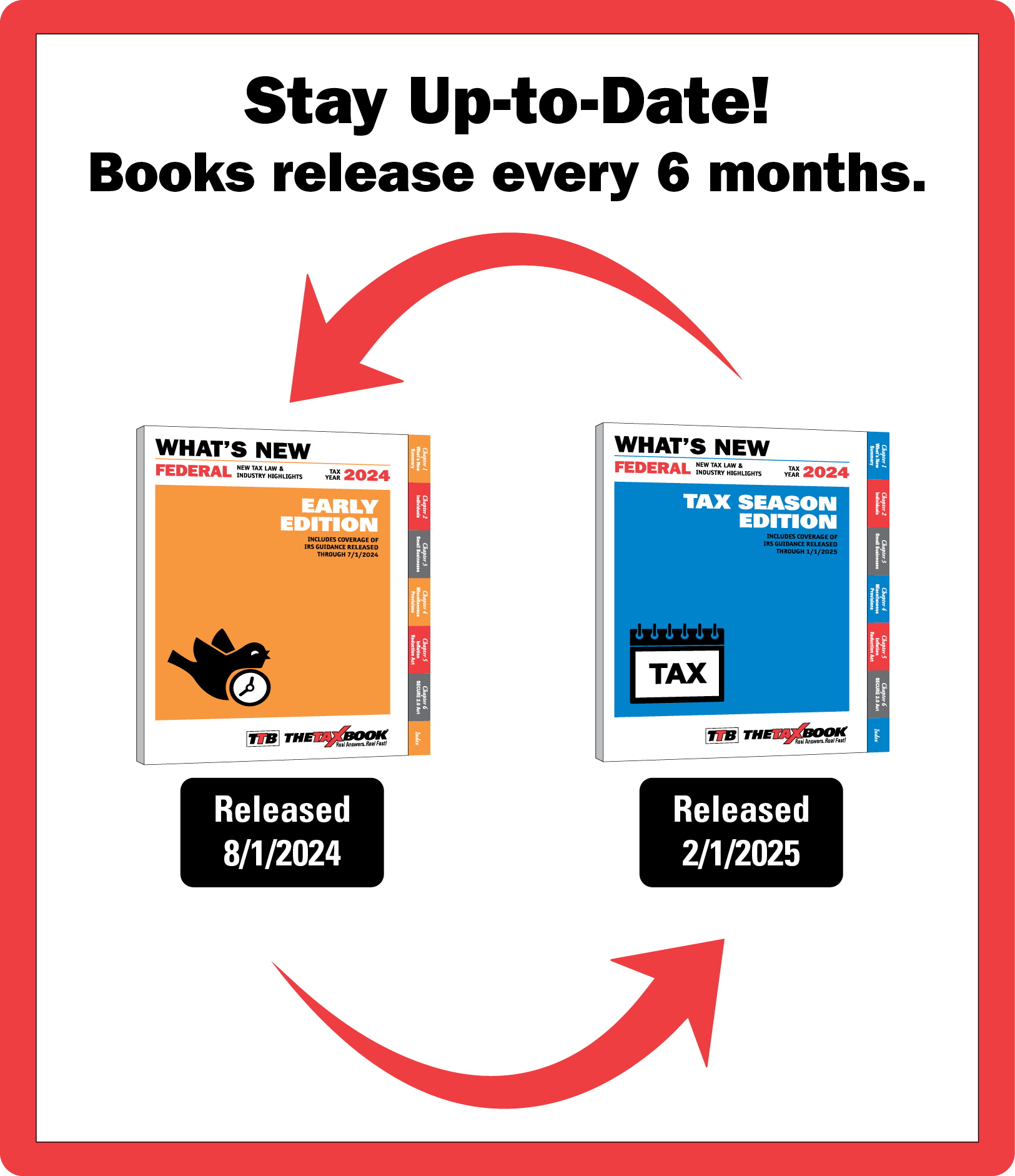

What's New Package

Stay up-to-date on the latest tax law changes and industry news. Includes regulations, revenue rulings, notices, announcements, court cases, and more.

| What's New Package Includes | Retail Value |

|---|---|

| What's New Tax Season Edition | $89 |

| What's New Early Edition | $89 |

| Free Shipping | $16 |

| Total Retail Value | $194 |

Start Ship Dates

- What's New Tax Season Edition, 2/2/26

- What's New Early Edition, 8/1/25